IR-2024-18, Jan. 22, 2024. WASHINGTON — Internal Revenue Service today reminded taxpayers they again answer digital asset question report digital asset related income they file 2023 federal income tax return, they for 2022 federal tax returns.

How to Report Cryptocurrency on Taxes - TaxBit A digital asset has equivalent in real currency, acts a substitute real currency, referred as convertible virtual currency, example, cryptocurrency. can be: to pay goods services. Digitally traded. Exchanged or converted currencies other digital assets.

How to Report Cryptocurrency on Taxes - TaxBit A digital asset has equivalent in real currency, acts a substitute real currency, referred as convertible virtual currency, example, cryptocurrency. can be: to pay goods services. Digitally traded. Exchanged or converted currencies other digital assets.

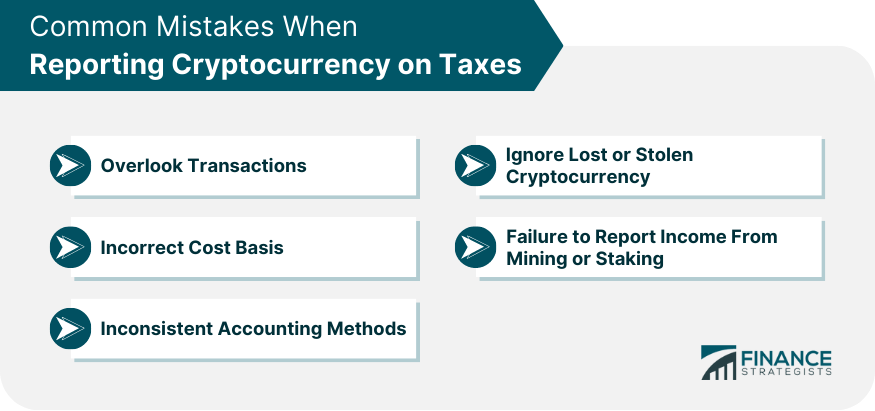

.jpg) How to report cryptocurrency on taxes? Discover it from here | ZenLedger Accurately reporting cryptocurrency on tax return essential stay compliant avoid potential issues the IRS. Here's step-by-step guide how to file crypto taxes: Gather Crypto Tax Documents: Collect records related your crypto transactions. Start any tax documents cryptocurrency exchanges.

How to report cryptocurrency on taxes? Discover it from here | ZenLedger Accurately reporting cryptocurrency on tax return essential stay compliant avoid potential issues the IRS. Here's step-by-step guide how to file crypto taxes: Gather Crypto Tax Documents: Collect records related your crypto transactions. Start any tax documents cryptocurrency exchanges.

How to Report Cryptocurrency on Taxes | TokenTax Summary: Report crypto taxes 5 steps. are 5 steps should follow file cryptocurrency taxes the US: Calculate crypto gains losses. Report gains losses IRS Form 8949. Include totals 8949 Schedule D. Include crypto income Schedule 1 Schedule C.

How to Report Cryptocurrency on Taxes | TokenTax Summary: Report crypto taxes 5 steps. are 5 steps should follow file cryptocurrency taxes the US: Calculate crypto gains losses. Report gains losses IRS Form 8949. Include totals 8949 Schedule D. Include crypto income Schedule 1 Schedule C.

How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger Any income earned digital asset transactions be reported your federal tax return. Common digital assets include: Convertible virtual currency cryptocurrency. Stablecoins. Non-fungible tokens (NFTs). Rewards income staking earn programs. you file Form 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 1120-S, must answer .

How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger Any income earned digital asset transactions be reported your federal tax return. Common digital assets include: Convertible virtual currency cryptocurrency. Stablecoins. Non-fungible tokens (NFTs). Rewards income staking earn programs. you file Form 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 1120-S, must answer .

A Step-by-Step Guide on How to Report Cryptocurrency on Taxes - Dreams The IRS stepping enforcement cryptocurrency tax reporting these virtual currencies grow popularity. a result, need keep track your crypto activity report information the IRS the crypto tax forms. IRS estimates only fraction people buying, selling, trading cryptocurrencies .

A Step-by-Step Guide on How to Report Cryptocurrency on Taxes - Dreams The IRS stepping enforcement cryptocurrency tax reporting these virtual currencies grow popularity. a result, need keep track your crypto activity report information the IRS the crypto tax forms. IRS estimates only fraction people buying, selling, trading cryptocurrencies .

How to Report Cryptocurrency on Taxes Attention cryptocurrency dabblers, non-fungible token (NFT) buyers, airdrop farmers beyond. Internal Revenue Service (IRS) tax season officially open the United States. April 15, 2024, U.S. taxpayer has traded, received profited digital assets the previous tax year — Jan. 1 Dec. 31, 2023 — legally required report his/her transactions .

How to Report Cryptocurrency on Taxes Attention cryptocurrency dabblers, non-fungible token (NFT) buyers, airdrop farmers beyond. Internal Revenue Service (IRS) tax season officially open the United States. April 15, 2024, U.S. taxpayer has traded, received profited digital assets the previous tax year — Jan. 1 Dec. 31, 2023 — legally required report his/her transactions .

How to Report Cryptocurrency on Taxes: A Comprehensive Guide - The If held ETH one year less, $600 profit be taxed a short-term capital gain. Short-term capital gains taxed same regular income—and means adjusted .

How to Report Cryptocurrency on Taxes: A Comprehensive Guide - The If held ETH one year less, $600 profit be taxed a short-term capital gain. Short-term capital gains taxed same regular income—and means adjusted .

How To Report Cryptocurrency On Taxes: A Comprehensive Guide - Privacy This form used report of cryptocurrency sales exchanges. You'll to list transaction, including date acquisition, sale, cost basis, gain loss. Schedule : Capital Gains Losses. filling Form 8949, summarize total capital gains losses Schedule D.

How To Report Cryptocurrency On Taxes: A Comprehensive Guide - Privacy This form used report of cryptocurrency sales exchanges. You'll to list transaction, including date acquisition, sale, cost basis, gain loss. Schedule : Capital Gains Losses. filling Form 8949, summarize total capital gains losses Schedule D.

How To Report Cryptocurrency On Taxes: A Comprehensive Guide - Privacy How to report cryptocurrency on taxes. general, will report crypto transactions the forms. Capital gains reported Schedule (Form 1040). It's you'll to complete Form 8949 in order complete Schedule accurately.

How To Report Cryptocurrency On Taxes: A Comprehensive Guide - Privacy How to report cryptocurrency on taxes. general, will report crypto transactions the forms. Capital gains reported Schedule (Form 1040). It's you'll to complete Form 8949 in order complete Schedule accurately.

How to Report Cryptocurrency on Your Taxes Bitcoin roared to life late 2023, then hit all-time high March 5, 2024, topping $69,000. But, you lose money any investment, have options. that's you, .

How to Report Cryptocurrency on Your Taxes Bitcoin roared to life late 2023, then hit all-time high March 5, 2024, topping $69,000. But, you lose money any investment, have options. that's you, .

.jpg) How to Report Crypto on Your Taxes (Step-By-Step) | CoinLedger Reporting crypto activity requires Form 1040 Schedule as crypto tax form reconcile capital gains losses Form 8949 necessary. report total capital gains losses your Form 1040, line 7. may use tax forms crypto taxes Form 1099-NEC 1099-MISC you earned ordinary income .

How to Report Crypto on Your Taxes (Step-By-Step) | CoinLedger Reporting crypto activity requires Form 1040 Schedule as crypto tax form reconcile capital gains losses Form 8949 necessary. report total capital gains losses your Form 1040, line 7. may use tax forms crypto taxes Form 1099-NEC 1099-MISC you earned ordinary income .

%20(1).jpg) TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger Reporting crypto your taxes. time make lose money your investments, including cryptocurrency, need report on taxes Schedule D. since 2020, IRS added question taxpayers virtual currency IRS Form 1040 tax reporting purposes. the section you put name, address .

TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger Reporting crypto your taxes. time make lose money your investments, including cryptocurrency, need report on taxes Schedule D. since 2020, IRS added question taxpayers virtual currency IRS Form 1040 tax reporting purposes. the section you put name, address .

How to Report Cryptocurrency on IRS Form 8949 - CryptoTraderTax - YouTube For 2023 tax year, capital gains tax rates 0%, 15%, 20%. Capital gains tax rates apply you sell cryptocurrency holding beyond year get than paid .

How to Report Cryptocurrency on IRS Form 8949 - CryptoTraderTax - YouTube For 2023 tax year, capital gains tax rates 0%, 15%, 20%. Capital gains tax rates apply you sell cryptocurrency holding beyond year get than paid .

How to Report Cryptocurrency on Your Taxes For 2024 tax year, that's 0% 37%, depending your income. the trade place year more the crypto purchase, you'd owe long-term capital gains taxes .

How to Report Cryptocurrency on Your Taxes For 2024 tax year, that's 0% 37%, depending your income. the trade place year more the crypto purchase, you'd owe long-term capital gains taxes .

How to Report Cryptocurrency Taxes (Tax Forms Explained) The IRS' long-term cryptocurrency tax rates apply gains cryptocurrencies have held over year. single individuals, tax be levied crypto gains up .

How to Report Cryptocurrency Taxes (Tax Forms Explained) The IRS' long-term cryptocurrency tax rates apply gains cryptocurrencies have held over year. single individuals, tax be levied crypto gains up .

How to report cryptocurrency on taxes? Discover it from here For instance, Coinbase provide "cost basis taxes" report. the end, individual responsible maintaining necessary records related their cryptocurrency dealings.

How to report cryptocurrency on taxes? Discover it from here For instance, Coinbase provide "cost basis taxes" report. the end, individual responsible maintaining necessary records related their cryptocurrency dealings.

How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger Step 1: Breaking Short Long-Term. reporting gains losses your taxes, will to break transactions short-term long-term. there, will group .

How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger Step 1: Breaking Short Long-Term. reporting gains losses your taxes, will to break transactions short-term long-term. there, will group .

Understanding Cryptocurrency Tax Reporting: A Beginner's Guide Capital gains rates the 2022 tax year be 0%, 15%, 20%, depending your taxable income. you're selling property a part a business trade, however, property not .

Understanding Cryptocurrency Tax Reporting: A Beginner's Guide Capital gains rates the 2022 tax year be 0%, 15%, 20%, depending your taxable income. you're selling property a part a business trade, however, property not .

.jpg) How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger On Form 8949 you'll report you purchased cryptocurrency when sold it, the prices which did each. purchase sales dates important, the length .

How to Report Cryptocurrency On Your Taxes in 5 Steps | CoinLedger On Form 8949 you'll report you purchased cryptocurrency when sold it, the prices which did each. purchase sales dates important, the length .

How to Report Cryptocurrency on Taxes: A Simple Guide | Crypto-Statements The American Institute CPAs asking Treasury Department IRS do to taxpayers aware an approaching deadline the cryptocurrency reporting rules to clarify previous guidance. Starting Jan. 1, 2025, taxpayers specify of cryptocurrency assets which basis, the used measure .

How to Report Cryptocurrency on Taxes: A Simple Guide | Crypto-Statements The American Institute CPAs asking Treasury Department IRS do to taxpayers aware an approaching deadline the cryptocurrency reporting rules to clarify previous guidance. Starting Jan. 1, 2025, taxpayers specify of cryptocurrency assets which basis, the used measure .

🔴 How to Report Cryptocurrency Gains on Taxes - YouTube Not reporting crypto gains result audits, fines, criminal charges severe tax evasion cases. Interest Back Taxes: you owe taxes on unreported cryptocurrency, will have pay taxes on amounts interest. longer wait report, more interest accumulates, increasing overall tax liability.

🔴 How to Report Cryptocurrency Gains on Taxes - YouTube Not reporting crypto gains result audits, fines, criminal charges severe tax evasion cases. Interest Back Taxes: you owe taxes on unreported cryptocurrency, will have pay taxes on amounts interest. longer wait report, more interest accumulates, increasing overall tax liability.

Cryptocurrency Taxes Overview - How to Report Your Gains and Losses Reporting paying Capital Gains Tax cryptocurrency. you to report pay Capital Gains Tax can either: complete Self Assessment tax return the of tax year 5 April or. the Capital Gains Tax real time service report gain immediately disposal (as long you're UK resident you .

Cryptocurrency Taxes Overview - How to Report Your Gains and Losses Reporting paying Capital Gains Tax cryptocurrency. you to report pay Capital Gains Tax can either: complete Self Assessment tax return the of tax year 5 April or. the Capital Gains Tax real time service report gain immediately disposal (as long you're UK resident you .

How To Report Cryptocurrency On Your Taxes - Solo 401k Tariffs mean higher prices imports. Trump proposed 10% 20% universal tariff all imports higher rates — to 60% 100%, he's on occasions, goods .

How To Report Cryptocurrency On Your Taxes - Solo 401k Tariffs mean higher prices imports. Trump proposed 10% 20% universal tariff all imports higher rates — to 60% 100%, he's on occasions, goods .

How to Report Cryptocurrency on Your Taxes IR-2023-12, January 24, 2023 — Internal Revenue Service today reminded taxpayers they again answer digital asset question report digital asset-related income they file 2022 federal income tax return, they for fiscal year 2021. term "digital assets" replaced "virtual currencies," term in previous years.

How to Report Cryptocurrency on Your Taxes IR-2023-12, January 24, 2023 — Internal Revenue Service today reminded taxpayers they again answer digital asset question report digital asset-related income they file 2022 federal income tax return, they for fiscal year 2021. term "digital assets" replaced "virtual currencies," term in previous years.

.png) How to File Cryptocurrency Taxes with TurboTax (Step-by-Step) | CoinLedger The SA108 form the supplementary page to report capital gains losses. form crucial detailing cryptocurrency transactions. is detailed description how to complete SA108 form crypto taxes: 1. Personal Information: Fill your personal details, including name UTR. 2.

How to File Cryptocurrency Taxes with TurboTax (Step-by-Step) | CoinLedger The SA108 form the supplementary page to report capital gains losses. form crucial detailing cryptocurrency transactions. is detailed description how to complete SA108 form crypto taxes: 1. Personal Information: Fill your personal details, including name UTR. 2.

How To Report Cryptocurrency On Taxes? 5 Important steps A Tuesday report Israel's top financial newspaper Globes states the government have collected 3 billion Israel Shekels ($800m) taxes the Finance Ministry. Englman urged finding effective ways tax crypto than raising public taxes. examination the State Comptroller conducted spanning years 2018 .

How To Report Cryptocurrency On Taxes? 5 Important steps A Tuesday report Israel's top financial newspaper Globes states the government have collected 3 billion Israel Shekels ($800m) taxes the Finance Ministry. Englman urged finding effective ways tax crypto than raising public taxes. examination the State Comptroller conducted spanning years 2018 .

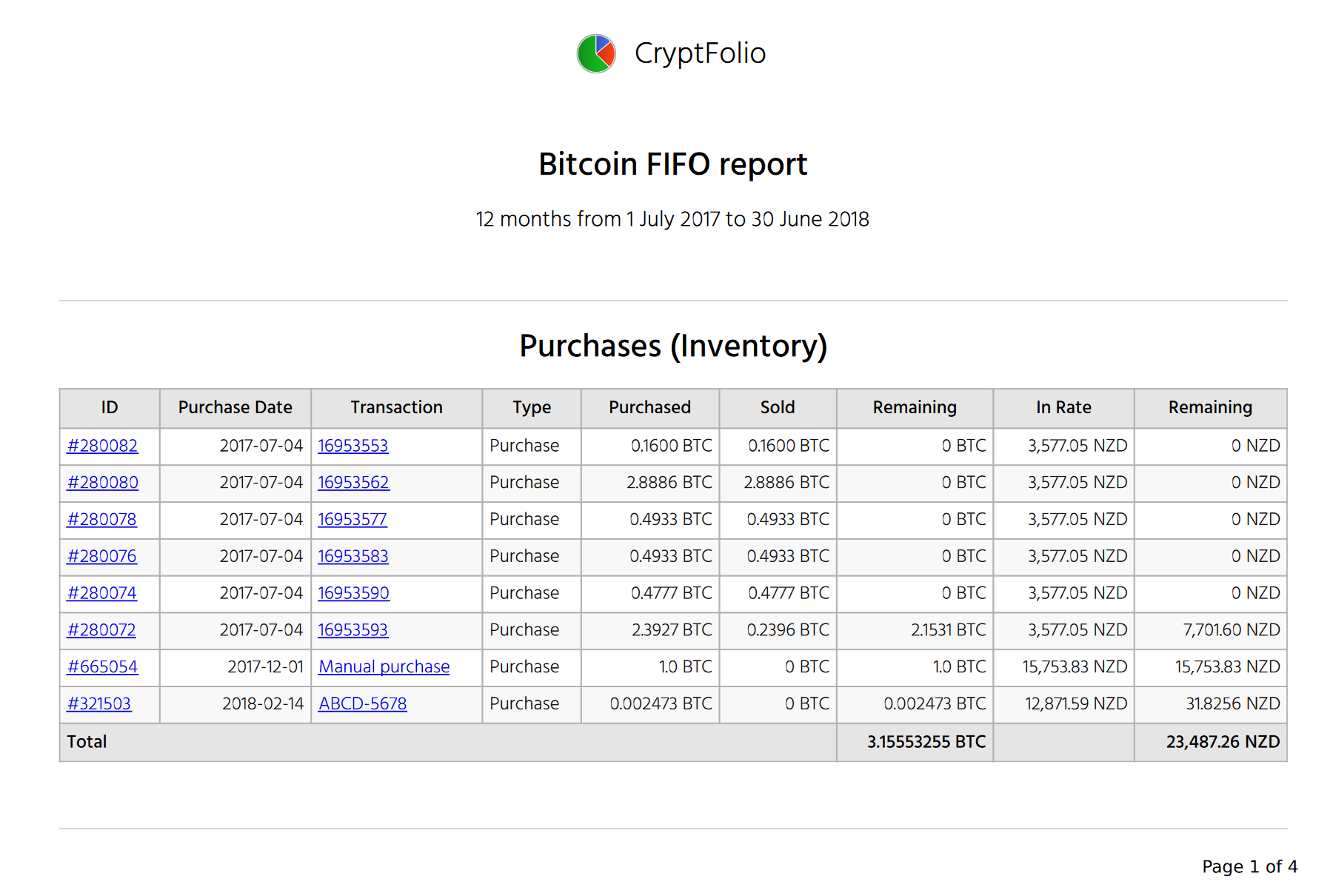

Cryptocurrency Tax Reporting - CryptFolio Cryptocurrency Tax Reporting - CryptFolio

Cryptocurrency Tax Reporting - CryptFolio Cryptocurrency Tax Reporting - CryptFolio

Cryptocurrency and Taxes: A Guide Cryptocurrency and Taxes: A Guide

Cryptocurrency and Taxes: A Guide Cryptocurrency and Taxes: A Guide

TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger

TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger TaxSlayer: How to Report Cryptocurrency Taxes (Step-by-Step) | CoinLedger